tax saving tips for high income earners uk

As tax allowances are progressively withdrawn on any income over 100000 there is also a marginal effective rate of c60 that applies to any income between 100000 and 125000. In this post were breaking down five tax-savings strategies that can help you keep more money in.

Meet Henry High Earners Infographic Equifax

Your allowance is reduced by 1 for every 2 you earn above 100000.

. However those with an Adjusted Net Income above 100000 start to lose thier personal allowance. Also offering high returns elss funds assistance in saving tax. If properly structured family trusts or partnerships can help you move your investment earnings to family.

Max Out Your Retirement Account. The annual pension allowance of 40000 is restricted for high earners such that for individuals with income over 240000 the allowance is restricted by 1 for every 2 of. Helping your highest earners invest tax-efficiently.

Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. One of the most effective ways for high earners in the UK to build wealth tax-efficiently is to save into a pension. Our tax receipt scanner app will.

5 reduce taxable income with a side. People know that pensions and ISAs offer tax reliefs within certain allowances. How to Reduce Taxable Income.

This bracket applies to single filers with taxable income in excess of 539900 and married couples filing jointly with taxable income in excess of 647850. Tax saving tips for high income earners uk Monday March 14 2022 Edit. Saving and investing within an ISA is another tax-efficient strategy for high earners to.

But there are high-earning clients whove exhausted these. If you are considered to be a high-income individual and have an adjusted. A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses.

High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning. Specifically contribute to a traditional 401 k or ira. Within a pension capital gains and dividend income are.

Qualified Charitable Distributions QCD 4. 6 Tax Strategies for High Net Worth Individuals. Most high income earners lose the ability to take many tax deductions because the tax laws are tilted so unfairly toward them contrary to popular opinion.

Here are five tax saving tips that are easy to apply. In fact Bonsai Tax can help. The more you make the more taxes play a role in financial decision-making.

Tax Advice For Any Golfer Golf Digest

Pay Less Tax Advice For Top Earners Rbc Brewin Dolphin

State Tax Tips For Millionaires Turbotax Tax Tips Videos

Tax Reduction Strategies For High Income Earners 2022

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

Top 20 Of Americans Will Pay 87 Of Income Tax Wsj

International Tax Competitiveness Index Tax Foundation

10 Ways To Reduce Your Tax Bill Frazer James Financial Advisers

9 Ways For High Earners To Reduce Taxable Income 2022

Income Taxes In The Uk A Guide For Expats Expatica

Uk Income Tax Rates 2019 20 What You Need To Know

Mini Budget Favours Wealthy Over Workers Says Murphy

Qualified Business Income Deduction Qbi What It Is Nerdwallet

Is The Great Rethink Shifting Consumer Behavior Deloitte Insights

Top Tips To Save Tax In Uk Frazer James Financial Advisers

10 Surefire Tax Tips For Year End 2021

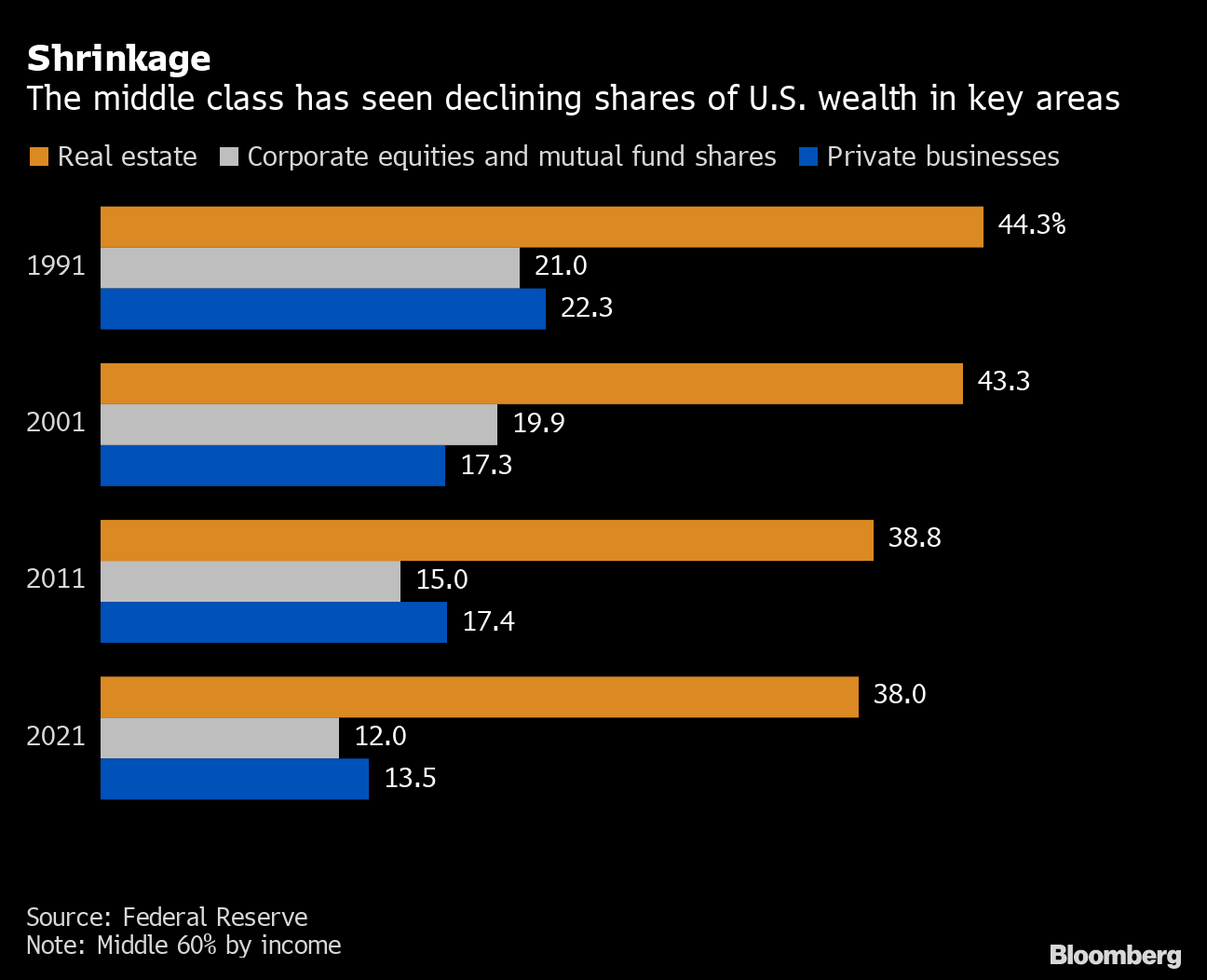

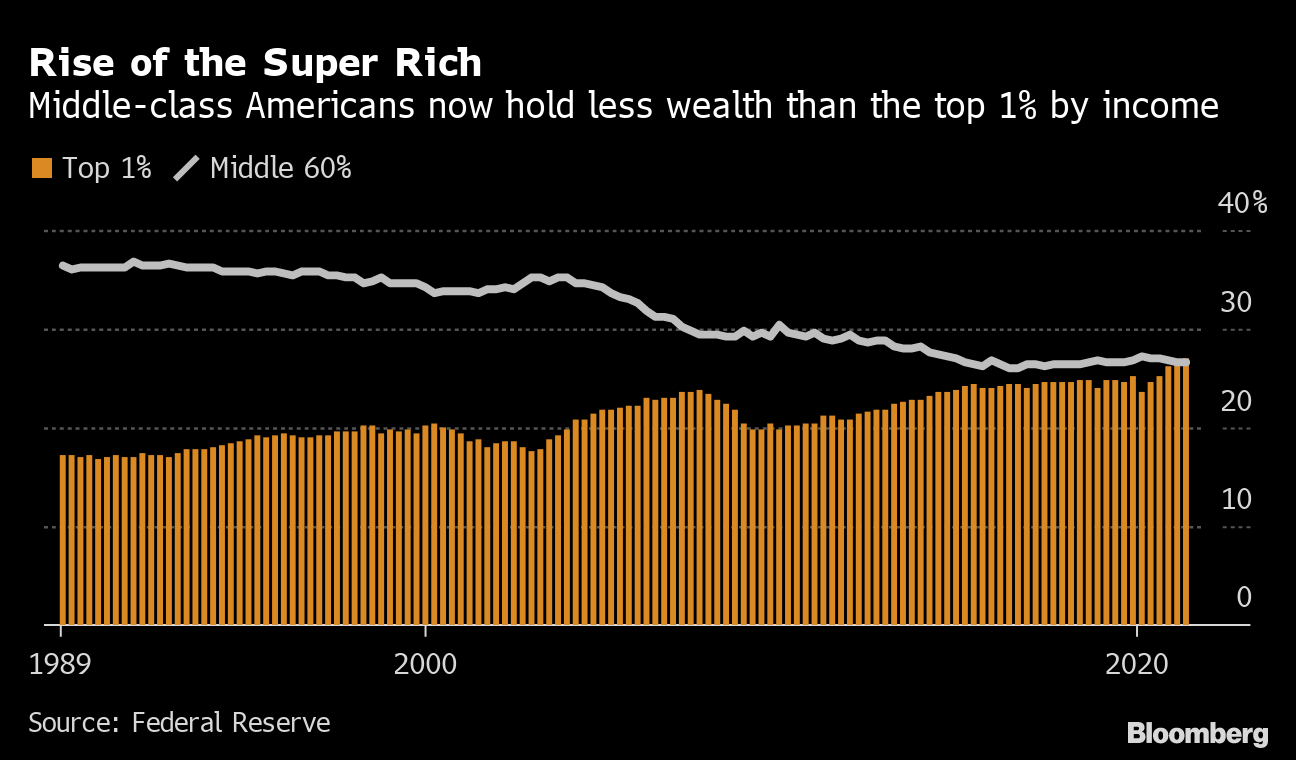

Top 1 Of U S Earners Now Hold More Wealth Than All Of The Middle Class Bloomberg